The Ultimate Guide To Ira Rubinstein - Overview - NYU School of Law

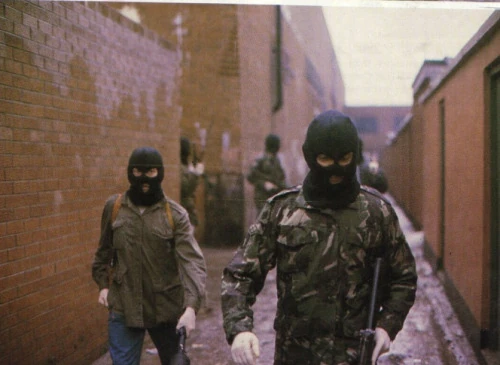

Irish Republican Army - Die Hard scenario Wiki - Fandom

The smart Trick of Empower IRA, Investing and Life Insurance – Empower That Nobody is Talking About

What Can You Contribute to a Roth IRA? The IRS dictates not just how much cash you can deposit in a Roth IRA however likewise the kind of cash that you can deposit. Essentially, Find More Details On This Page can just contribute made earnings to a Roth individual retirement account. For people working for a company, settlement that is qualified to fund a Roth IRA consists of wages, wages, commissions, bonus offers, and other amounts paid to the person for the services that they perform.

For a self-employed individual or a partner or member of a pass-through service, payment is the person's net profits from their service, less any reduction permitted contributions made to retirement plans on the individual's behalf and additional decreased by 50% of the individual's self-employment taxes. Money associated to divorcealimony, kid assistance, or in a settlementcan likewise be contributed if it relates to taxable spousal support received from a divorce settlement performed prior to Dec.

While there's British interference, there's going to be action': why a hardcore of dissident Irish republicans are not giving up - Northern Ireland - The Guardian

Not known Details About Individual Retirement Accounts - FINRA.org

So, what sort of funds aren't eligible? The list consists of: Rental income or other make money from residential or commercial property maintenance Interest income Pension or annuity earnings Stock dividends and capital gains Passive earnings earned from a collaboration in which you do not offer substantial services You can never ever contribute more to your IRA than your made earnings because tax year.

The Irish Republican Army Way – And The Taliban Way – AN SIONNACH FIONN

Who's Eligible for a Roth IRA? Anybody who has earned earnings can contribute to a Roth IRAas long as they satisfy particular requirements concerning filing status and modified adjusted gross earnings (MAGI). Those whose yearly earnings is above a specific quantity, which the IRS changes regularly, become ineligible to contribute.